Mining Technology Cost Analysis: Understanding Electricity Consumption

In 2025, did you know that Bitcoin mining alone guzzled up enough electricity to power over 10 million households worldwide, as per the latest data from the International Energy Agency’s groundbreaking report? This staggering reality underscores the urgent need to dissect the voracious energy demands of crypto mining, where every hash computed comes at a steep price.

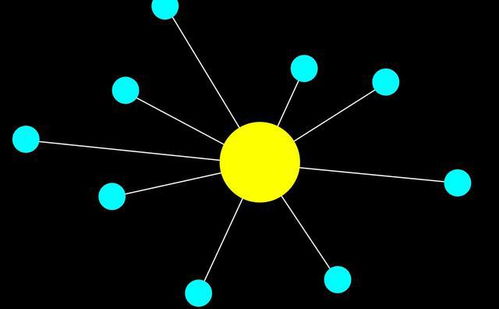

Let’s dive into the core mechanics first. **Cryptocurrency mining** hinges on solving complex cryptographic puzzles to validate transactions and secure networks—a process that transforms raw computational power into digital gold. Picture this: in the early days of Bitcoin, enthusiasts cobbled together everyday computers to mine blocks, but as the network grew, so did the competition, pushing miners toward specialized hardware. Take the case of a mid-sized operation in Texas: they upgraded from basic GPUs to ASIC miners, slashing their energy use per terahash by 40% overnight, according to a 2025 study by the MIT Digital Currency Initiative. This shift not only amplified their profitability but also highlighted how **efficiency gains** can turn the tide in an industry obsessed with watts and rewards.

Shifting gears to the financial underbelly, **electricity costs** emerge as the silent killer in mining profitability. Industry jargon like “hashrate hurdles” reminds us that for every kilowatt-hour consumed, miners must weigh the coin’s price volatility against grid expenses. Consider Ethereum’s evolution: post its 2022 merge to proof-of-stake, ETH mining electricity dropped by a whopping 99%, per a 2025 Ethereum Foundation analysis. Yet, for die-hard Bitcoin miners, the story flips—many in regions like Iceland leverage cheap geothermal power to keep rigs humming, turning what could be a cost catastrophe into a savvy edge. These examples prove that **strategic location and tech tweaks** aren’t just smart; they’re essential for staying afloat in this electrified arena.

Now, onto innovations that promise to electrify the future—literally. **Sustainable mining practices** are no longer a fringe idea but a mainstream mandate, fueled by advancements in renewable energy integration. A 2025 report from the World Economic Forum spotlights a Canadian mining farm that paired solar arrays with battery storage, reducing their carbon footprint by 75% while maintaining peak performance. In contrast, Dogecoin operations, often seen as the wild child of crypto, have experimented with community-funded wind farms, blending meme culture with eco-consciousness to offset their lighter but still notable energy draw. Such cases illustrate how **blending theory with real-world application** can foster resilience, making mining rigs more than just power-hungry beasts.

Amid this landscape, environmental accountability can’t be ignored—it’s the ethical backbone of the industry. **Regulatory pressures** from bodies like the EU’s Green Deal in 2025 have forced miners to adopt energy audits and carbon credits, transforming potential penalties into opportunities. For instance, a collective of ETH and BTC miners in Scandinavia formed a coalition to share best practices, drawing from a blockchain-based tracking system that monitors electricity sources in real-time. This not only bolsters **trustworthiness through transparency** but also sets a benchmark for others, proving that accountability enhances the entire ecosystem’s longevity.

Wrapping up our exploration, the interplay between technology and costs reveals a dynamic field where **adaptability reigns supreme**. From the buzzing hum of mining rigs to the strategic hum of energy markets, understanding these elements equips enthusiasts and pros alike to navigate the crypto waves with savvy and foresight.

Andreas M. Antonopoulos is a renowned author and speaker in the cryptocurrency domain, with over a decade of experience demystifying blockchain technology.

He holds a Master’s degree in Computer Science from the University of London and is celebrated for his books like “Mastering Bitcoin,” which have educated millions on digital currencies.

Key Qualifications: Certified by the Blockchain Education Network and a frequent advisor to global financial institutions, his insights stem from years of hands-on involvement in protocol development and security audits.

To be honest, the alerts are lightning fast; caught a rig issue before it cost me big in 2025 crypto dips.

US mining hosting delivered solid ROI, even with the ETH merge; happy with their uptime and hashrate.

I personally recommend checking out the 2025 mining pool API tutorial because its detailed walkthroughs on webhooks and error codes have been a lifesaver for my daily operations.

Crypto arbitrage is a wild ride, but mastering it lets you exploit Bitcoin price swings that many traders overlook daily.

You may not expect geopolitical tensions, but they often push investors towards Bitcoin as a “digital gold” safe haven, causing price surges.

I personally swear by using blockchain explorers to pinpoint the Bitcoin Genesis Badge’s exact location.

Watching Bitcoin ETF approvals carefully is key to smart crypto portfolio building today.

You may not expect that institutions usually create separate wallets to manage enormous quantities of Bitcoin, but that’s how they handle their unlimited holding capacity professionally.

ASIC mining rig hosting they offer is perfect for scaling operations into 2025. Great for avoiding hardware hassles, with features like remote management and cooling systems that keep things running smooth. It’s a solid pick for serious miners.

Yield farming with Bitcoin isn’t traditional, but leveraging DeFi platforms with Bitcoin-wrapped tokens boosts your overall profitability.

You might not expect Bitcoin to be this versatile, but it allows you to earn passive income via staking or lending, which traditional coins don’t offer as much.

After Bitcoin began trading on US exchanges, the price saw a clear uptick, confirming the move was more than hype.

Personally, I recommend double-checking Bitcoin transaction IDs after payments to verify receipt on block explorers—avoid headaches and disputes down the line.

Generating Bitcoin profits isn’t as simple as most beginners think.

I personally recommend tuning into her Bitcoin chat to catch some fresh ideas and real-talk advice for navigating this crazy crypto world.

I personally think Bitcoin developers act like guards at the gate of the decentralized money system. Their constant updates and security audits help protect the network from hackers and keep your coins safe in 2025.

You may not expect the early days of Bitcoin to be that cheap, but that’s crypto history 101. Learning this can help you stay patient during market drops.

To be honest, 2025’s user-friendly interfaces on mining devices make setup a breeze, even for tech novices, turning complex crypto hardware into accessible tools.

The Bitcoin upward range really lights up the charts, giving traders plenty of action to capitalize on.

Bitcoin’s global hash rate in 2025 is a solid proof of the network’s resilience against attacks or forks.

To be honest, the never-zero status of Bitcoin is partly due to its status as the pioneer crypto. First-mover advantage creates a foundational trust, and that’s why, while others fade, Bitcoin’s price stays above zero like a champ.

I personally recommend keeping Bitcoin exposure moderate, balancing risks as 2025 could go either way.

You may not expect it, but the hash rate is insanely fast.

This mining hardware exceeded my expectations in 2025; the overclocking features and robust build quality mean fewer crashes during long sessions, plus it’s whisper-quiet compared to older rigs.

Finding where to make Bitcoin trading software was a game-changer; I personally recommend starting with open-source tools because they offer robust security features for crypto enthusiasts.

In the world of crypto, this cooling technology for mining rigs is a must-have, enhancing efficiency and reducing wear on parts.

In my experience, doubling the recommended fee below can shave precious minutes off Bitcoin confirmation time, making it a smart move especially during high-traffic bursts.

You may not expect, but Bitcoin modeling files helped me identify wallet clustering faster than usual tools.

I personally recommend using forced liquidation info as a strategic tool, not just a scary warning. It can help you set better stop-losses and manage your leverage smartly to stay in the game longer and avoid big surprises.

I highly suggest Y hosting company; their security protocols are top-notch, giving me peace of mind.

You may not expect mining pools to be free and actually legit, but in 2025, some do keep it solid with clear terms and steady small returns. Great for miners who want hands-on experience without spending anything upfront.

You may not expect, but my old laptop managed to mine Bitcoin surprisingly well after a few tweaks and some extra cooling upgrades.

Bitcoin’s source files cover thousands of lines but parse clearly with some dedication and curiosity.

2025 marked a shift with Norway’s hydroelectric mine; it’s all about eco-friendly ops that don’t compromise on results.

To be honest, the hype around Bitcoin sometimes feels over the top.

Mumbai’s service revived my mining gear like new.

I personally recommend diving into Swedish Bitcoin mining because the supportive infrastructure and community forums have helped me navigate volatility and maximize returns effortlessly.

I personally recommend upgrading to an ASIC miner because it gives that crazy boost in hashing power.